What is a Mutual Fund?

Many people don’t know about mutual funds. Here, we will explain what they are in a simple way.

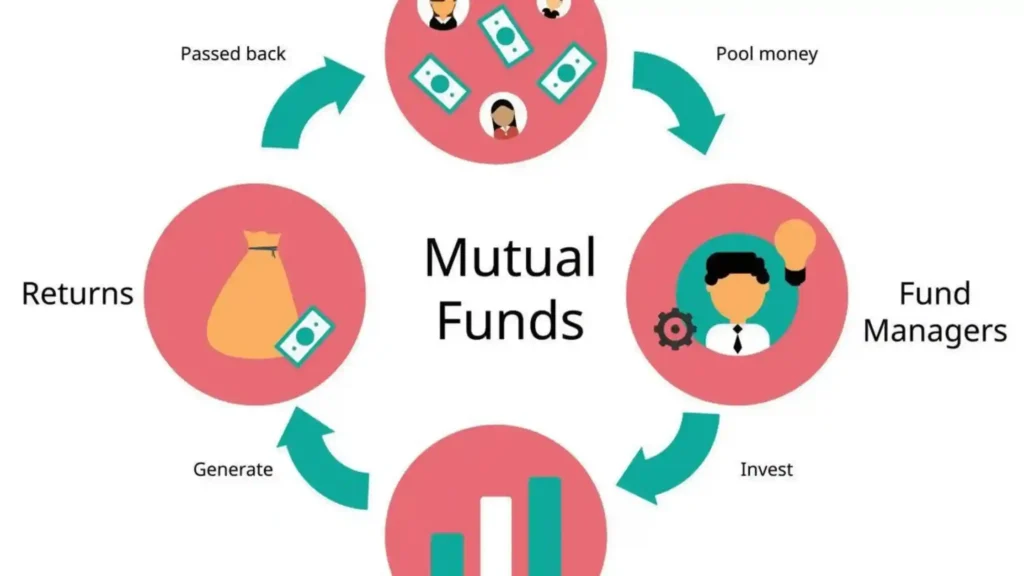

A mutual fund is a type of investment scheme run by different financial companies. It means that your money is invested in the share market, and you earn returns based on market performance.

How Do Mutual Funds Work?

Financial companies create different schemes and give them a name.

The money collected in these schemes is invested in different companies listed in the share market.

Each mutual fund is managed by expert fund managers and their teams.

If you invest for a long time, you can get good returns due to compound interest.

In this article, I will explain a special mutual fund that requires very low investment, making it affordable even for labour-class workers who want to invest for the long term and earn good returns.

Types of Mutual Funds

There are two types of mutual funds:

Flexible Investment: You can invest any amount based on your savings each month. There is no fixed amount, so you can invest whenever and however much you want.

SIP (Systematic Investment Plan): In this, you need to fix a monthly amount, which will be automatically deducted from your bank account every month.

Earlier, the minimum SIP investment was ₹500 per month, but now SBI has launched a new SIP option where you can start with just ₹250 per month.

Start Investing in Mutual Funds with Just ₹250!

Good news for everyone! Now, you can start investing in mutual funds with just ₹250. SBI Mutual Fund has launched a new SIP (Systematic Investment Plan) called Jannivesh SIP, making it easier for more people to invest.

Usually, people invest ₹500 or more in SIPs, but some schemes allow investments as low as ₹100. To encourage more people to invest, SBI Mutual Fund has set the minimum amount at ₹250, similar to how small-sized products are sold in the consumer goods market.

Why is This Important?

Nand Kishore, MD & CEO of SBI Mutual Fund, said that lowering the entry amount and using digital platforms will help attract:

First-time investors

Small savers

People from the unorganized sector

At the launch event, SEBI Chairperson Madhabi Puri Buch was also present. SBI Chairman C S Shetty said that as India moves towards financial inclusion, it is important to develop better products and technology to make investing simple and accessible for everyone.

Now, with just ₹250, you can start your investment journey!

Note: This article is for educational purposes only, not for investment advice.