Budget 2025

Our Finance Minister Nirmala Sitharaman has already finished the budget today and like always, this time also we middle class people keep our eyes on taxes.

Through this article we will learn about the new tax slabs in details, so let us start from the beginning.

The main highlight of Finance Minister Nirmala Sitharaman’s eighth Budget is the tax relief for middle-class salaried taxpayers. However, the announcement of revised tax slabs has left many people confused about how much relief they will actually get.

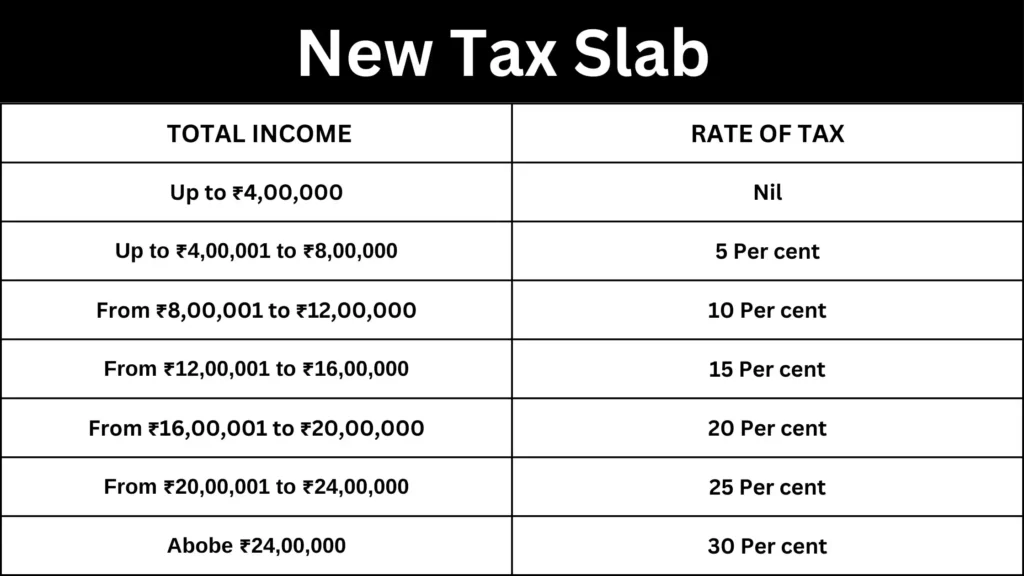

Revised Tax Slabs in Budget 2025

Income up to ₹4 lakh – No tax (earlier ₹3 lakh).

₹4 lakh – ₹8 lakh – 5% tax (earlier ₹3 lakh – ₹7 lakh).

₹8 lakh – ₹12 lakh – 10% tax (earlier ₹7 lakh – ₹10 lakh).

₹12 lakh – ₹16 lakh – 15% tax (earlier ₹12 lakh – ₹15 lakh).

₹16 lakh – ₹20 lakh – 20% tax (new slab, earlier part of 30% slab).

₹20 lakh – ₹24 lakh – 25% tax (new slab, earlier part of 30% slab).

Above ₹24 lakh – 30% tax (earlier applied to income above ₹15 lakh

What Changed?

The zero-tax limit has increased from ₹3 lakh to ₹4 lakh.

The 5% tax bracket now applies to ₹4 lakh – ₹8 lakh instead of ₹3 lakh – ₹7 lakh.

The 10% tax bracket has moved from ₹7 lakh – ₹10 lakh to ₹8 lakh – ₹12 lakh.

The 15% tax bracket now covers ₹12 lakh – ₹16 lakh instead of ₹12 lakh – ₹15 lakh.

The earlier 30% tax on income above ₹15 lakh has been broken into three new slabs:

₹16 lakh – ₹20 lakh (20% tax)

₹20 lakh – ₹24 lakh (25% tax)

Above ₹24 lakh (30% tax)

How Income Up to ₹12 Lakh Can Be Tax-Free Under Budget 2025?

The government will provide tax rebates for those earning up to ₹12 lakh. For salaried individuals, this limit is ₹12.75 lakh, including a standard deduction of ₹75,000.

The rebate amounts increase with income:

₹8 lakh income – ₹10,000 rebate

₹12 lakh income – ₹80,000 rebate

These rebates help reduce taxable income, making earnings up to ₹12 lakh effectively tax-free.

How Will Be Tax Calculate above 16 Lakh Salary?

Income of ₹16 Lakh

Here in simple way i have try to explain:

No tax on income up to ₹4 lakh.

5% tax on ₹4 lakh – ₹8 lakh → ₹20,000.

10% tax on ₹8 lakh – ₹12 lakh → ₹40,000.

15% tax on ₹12 lakh – ₹16 lakh → ₹60,000.

Total tax payable: ₹1, 20,000, which is ₹50,000 less than before.

Income Above ₹50 Lakh, Tax?

Under the new tax slabs, a person earning ₹50 lakh per year will now pay ₹10,80,000 in tax.

This is ₹1, 10,000 less than the previous tax structure.

The new slabs provide relief to middle-income earners while also benefiting high-income individuals.

What about the Old Tax Regime?

The new slabs apply only to those choosing the New Tax Regime.

The government aims to simplify taxation by removing exemptions in this regime.

The Old Tax Regime remains unchanged, as neither the Finance Minister nor the Budget document mentioned any revisions.

This means taxpayers can still choose between the old and new regimes, but the government is encouraging a shift to the new one.

Can We Choose the New or Old Tax Regime?

Your choice between the new and old tax regimes depends on how many exemptions you can claim.

For example, if your income is ₹16 lakh and you claim ₹4 lakh in exemptions, your taxable income becomes ₹12 lakh. Under the old tax regime, you would pay ₹1,72,500 in tax—₹52,000 more than under the new regime.

Divya Baweja, Partner at Deloitte India, explains that to decide which regime is better, you should compare the deductions and exemptions available in the old regime with the benefits of the new regime. Since the new regime has wider tax slabs, you would need higher deductions in the old regime to make it equally beneficial.

Choosing the right regime depends on your financial situation and the exemptions you can claim.